News

PPC Trading Cheaper Than Industry: What's Next for Investors?

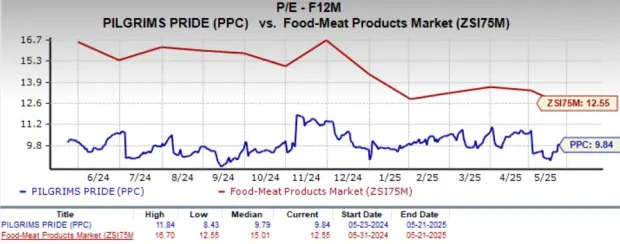

Pilgrim's Pride Corporation PPC, one of the world's leading food companies, currently trades at a forward 12-month price-to-earnings ratio of 9.84X. The figure is below the industry and the S&P 500’s average of 12.55X and 21.49X, respectively, highlighting PPC as a potentially undervalued stock. For investors, this presents an attractive opportunity, which is further underscored by PPC’s current Value Score of A.

PPC Stock P/E Performance

PPC’s shares have gained 2.3% in the past three months against the industry and the S&P 500 index’s decline of 0.9% and 2.3%, respectively.

Let us delve into the financial and strategic fundamentals that underpin Pilgrim’s Pride’s current position in the market.

Decoding PPC’s Growth Strategy

Pilgrim’s Pride is well-positioned for continued growth, supported by strong consumer demand for chicken, strategic market positioning and enhanced operational efficiencies. The company’s focus on key customers is helping refine its portfolio and build competitive advantages over peers. As a result, Pilgrim’s Pride reported first-quarter 2025 adjusted earnings of $1.31 per share, up from 77 cents in the prior-year quarter.

Pilgrim’s Pride is set to benefit from a favorable supply-demand environment in 2025, supported by steady consumer demand and rising protein production. The USDA anticipates a 1.7% year-over-year increase in U.S. chicken production for 2025, along with a 1.6% rise in overall protein availability, driven by gains in both chicken and pork. This backdrop supports strong pricing for Pilgrim’s Pride’s products. Additionally, the company’s efforts to expand its branded product portfolio and strengthen distribution with key customers provide a solid foundation for continued growth.

Pilgrim’s Pride benefited from a reduction in the cost of sales in the first quarter of 2025. The company’s cost of sales decreased to $3,908.1 million from $3,978 million in the prior-year quarter, contributing to a significant increase in gross profit, which rose to $554.9 million from $383.9 million. These improvements underscore Pilgrim’s Pride’s operational efficiency and effective cost management, positioning it favorably in a competitive market.

Pilgrim’s Pride continues to build momentum through its strong focus on innovation and brand diversification. In the first quarter of 2025, the company introduced more than 80 new products by March, highlighting its commitment to expanding and refreshing portfolio. This strategy is yielding results, with combined sales of the Just BARE and Pilgrim's brands surging more than 50%. Overall, key brands are gaining traction, supported by year-over-year increases in both sales and volume.

PPC Three Months Performance Chart

Estimate Revisions Favoring PPC Stock

Reflecting positive sentiment around Pilgrim’s Pride, the Zacks Consensus Estimate for earnings per share has seen upward revisions. Over the past 30 days, the consensus estimate has risen 13 cents to $5.41 for the current fiscal and 25 cents to $4.82 per share for the next fiscal. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Are Headwinds Enough to Derail PPC’s Momentum?

Pilgrim’s Pride faces challenges in its export business, particularly due to trade uncertainties and biosecurity concerns. The company experienced a decline in export volumes in the first quarter of 2025 compared with the first quarter of 2024, due to several factors, including winter weather-related port disruptions in January, concerns over a potential port strike and strong domestic demand for dark meat, which constrained the supply available for international markets.

Pilgrim’s Pride also has been experiencing higher selling, general and administrative expenses (SG&A) for a while now. In the first quarter of 2025, the SG&A expenses were $133.8 million, up from $119.1 million reported in the prior year quarter. The increase was primarily due to higher legal settlement and defense costs, as well as elevated incentive compensation. If not effectively managed, the continued increase in such expenses could further impact the company’s profitability in the coming quarters.

PPC Stock Analysis

Pilgrim’s Pride’s strong operational execution, robust consumer demand and focus on branded product innovation position it well for continued growth. The company’s attractive valuation and rising earnings estimates further support its long-term potential. However, near-term headwinds, including export volume pressures, higher SG&A expenses and external trade uncertainties, could weigh on its performance. Given these mixed factors, investors may consider holding onto PPC stock while monitoring cost trends and international market recovery. At present, PPC carries a Zacks Rank #3 (Hold).

Top-Ranked Stocks

Nomad Foods Limited

NOMD manufactures, markets and distributes a range of frozen food products in the United Kingdom and internationally. It currently sports a Zacks Rank of 1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

The Zacks Consensus Estimate for Nomad Foods' current fiscal-year sales and earnings implies growth of 4.6% and 7.3%, respectively, from the prior-year levels. NOMD delivered a trailing four-quarter earnings surprise of 3.2%, on average.

Mondelez International, Inc.

MDLZ manufactures, markets and sells snack food and beverage products in Latin America, North America, Asia, the Middle East, Africa and Europe. It presently carries a Zacks Rank of 1. MDLZ delivered a trailing four-quarter earnings surprise of 9.8%, on average.

The Zacks Consensus Estimate for Mondelez International’s current financial-year sales indicates growth of 4.9% from the year-ago numbers.

Oatly Group AB

OTLY, an oatmilk company, provides a range of plant-based dairy products made from oats. It presently carries a Zacks Rank of 2 (Buy). OTLY delivered a trailing four-quarter earnings surprise of 25.1%, on average.

The consensus estimate for Oatly Group’s current fiscal-year sales and earnings implies growth of 2.7% and 65.8%, respectively, from the year-ago figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pilgrim's Pride Corporation (PPC) : Free Stock Analysis Report

Mondelez International, Inc. (MDLZ) : Free Stock Analysis Report

Nomad Foods Limited (NOMD) : Free Stock Analysis Report

Oatly Group AB Sponsored ADR (OTLY) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research