News

State of Freight takeaways: Freight crash may turn into sudden revival

What a difference a month makes.

Four weeks after the April State of Freight webinar , when a raging trade war looked to wreak havoc on freight markets, the May edition of the monthly series confronted conditions that were getting at least a temporary reprieve because of the 90-day truce agreed upon by China and the United States.

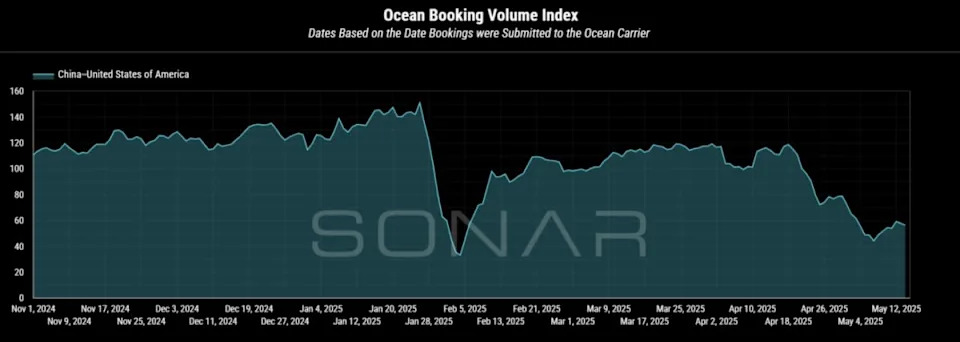

The first signs of change are indications that freight movement from China to the U.S., pushed down sharply by the Trump administration’s 145% tariffs, is starting to rebound.

In the State of Freight webinar for May, FreightWaves and SONAR CEO Craig Fuller and SONAR Director of Freight Market Intelligence Zach Strickland discussed what the changes mean for freight markets. Here are five takeaways.

A surge – but when?

Strickland and Fuller discussed when a renewed surge of freight might begin to make its way to U.S. shores. According to Strickland, the “pull-forward” freight that had been rushed to the U.S. in anticipation of the “Liberation Day” tariffs “really hit the coasts at different points in time.”

Fuller said the market is on the verge of a “short-term bounce back, which is definitely happening.” It’s likely to last for a week or two weeks as Chinese exporters of products to the U.S. move to resume shipments. It may last longer than that, he added, possibly as much as a month.

Strickland and Fuller compared what the surge would be like. Strickland suggested the rise might be like the end of Chinese New Year, when the drop in exports during that January or February period is followed by a sudden turnaround. Fuller likened the upcoming surge to the freight market coming out of COVID, “when we saw this shutting off of the economy and then turning it all back on.”

“The concentration of orders is just so tight, I think it’s going to be a pretty substantial rebound, and I think it will show up in trucking data pretty soon,” Fuller added.

But creating uncertainty, he said, is the fact that nobody is sure what comes after the 90-day truce is over.

Intermodal strong again

Fuller and Strickland have spoken on earlier webinars about the strength of the intermodal market. They both said a coming surge of imports is likely to keep that market robust.

With imports having come in before the 90-day pause in implementing stiff tariffs on both the Chinese and U.S. sides in order to “beat the clock,” and the likelihood that it may come again as importers seek to get product to U.S. shores, moving product to warehouses or end users by rail with no hard time constraints looks increasingly attractive, they said. “It’s easiest to just say, ‘I’m going to pull that container right off a boat and put it onto the rails, because I have an extended lead time,’” Fuller said.

Strickland conceded that when he was in the trucking sector, “I didn’t look at intermodal at all.” But an overall decline in the Outbound Tender Volume Index (OTVI), which a year ago was about 11,400 and is now about 10,400, suggests that volume that might have shown up in OTVI in the past is now on the rails. Other demand indicators suggest, Strickland said, that “we can clearly see that we have not had demand fall over the last year, not to the extent that you know the truckload volumes would suggest in the OTVI.”

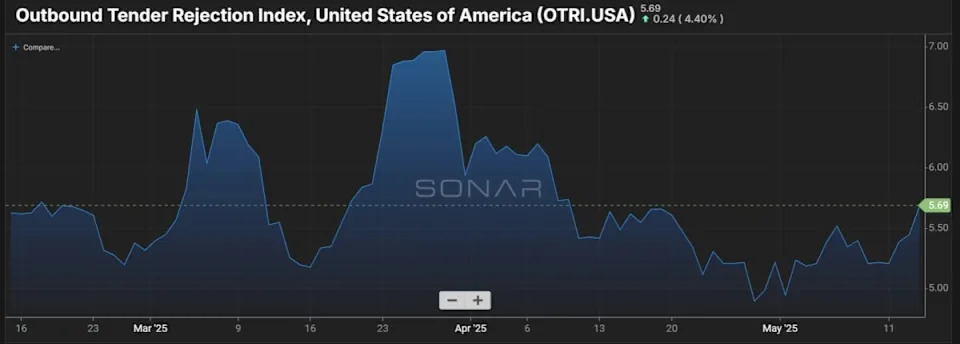

Tender rejections holding steady

Trucking capacity as measured by the Outbound Tender Rejection Index, even in the face of a possible downturn in demand, has been hanging in near the 5% level, Fuller noted. And that is occurring during an earnings season that saw several truckload carriers reporting weak results, including operating ratios in excess of 100%.

“What is interesting is that volumes are really weak,” Fuller said. “And so it is interesting how well the market has performed in terms of rejections.”

Referring to earlier comments in the webinar that markets might be ready for a “violent snapback” in freight volumes as Chinese imports surge anew, Fuller said the steady OTRI level could mean that even in the face of a recession, “the freight market will do well. And the reason is that the freight market is responding to trade manipulation, trade impacts, trade absorption, issues that have nothing to do with the broader economy, and they will insulate the broader freight market from some of the other economic challenges, and as long as there is that surge of uncertainty in trade, it will create more freight demand.”

Impact of International Roadcheck

Another factor in the steady OTRI has been International Roadcheck, which ran from Tuesday through Thursday this week. Fuller has said on earlier webinars that the rise in OTRI last year during Roadcheck was one of the first signs that trucking capacity was tightening slightly, given that the annual phenomenon of drivers staying home that week to avoid the stepped-up enforcement had not shown up as impacting OTRI for several years prior.

Based on his discussions with people in the industry, Fuller said that “capacity is tight. It is hard for brokers to find capacity.” And that’s even with the fact that “volumes have been pretty anemic over the last couple of weeks.”

The risks of Roadcheck are real, Fuller said. If a driver is taken out of service because of a safety violation, “you go out of service for a period of time, and then you basically have to deal with whatever issue exists and prove that you’ve taken care of it.”

And it doesn’t stop there, he said. “It impacts your insurance rates,” he said. “It shows up if there’s ever a court case against them. Even shippers if they find you have a lot of out-of-service incidents will not give you freight because they consider you an at-risk carrier.”

Will the English language mandate be enforced?

With President Donald Trump giving new life to an old federal regulation requiring that truck drivers be required to speak English, a questioner to the State of Freight webinar asked how strongly it would be enforced.

Fuller said he believes enforcement will be on a state-by-state basis. Traditionally red states, he said, “absolutely will probably enforce those rules,” he said. “I think in parts of the rest of the country, like California and New York, those are going to be more challenged.”

Law enforcement officials tend to be more conservative, Fuller said, and he cited a conversation at the recent Mid-America Trucking Show with a California highway trooper who said in the past, his “hands were tied” when it came to enforcing the rule. “I think there will be more enforcement of this,” he added.

More articles by John Kingston

California deal with 16 states would end key parts of Advanced Clean Fleets rule

2 markets in 1 quarter: Auto-hauling demand volatile for Proficien t

New Jersey, feds take opposite paths on independent contractor rules

The post State of Freight takeaways: Freight crash may turn into sudden revival appeared first on FreightWaves .