News

3 Must-Buy U.S. Corporate Behemoths Despite Recent Volatility

Wall Street has suffered severe volatility in the past two months. Sticky inflation, a series of weak economic data and the Trump administration’s imposition of reciprocal tariffs raised concerns among market participants about a near-term recession in the U.S. economy. All three major stock indexes are in negative territory year to date.

However, three U.S. corporate giants (market capital nearly $100 billion or more) with a favorable Zacks Rank have provided positive returns in the past month. Investment in these stocks should be prudent in the near future.

These stocks are: Amphenol Corp. APH, AppLovin Corp. APP and Philip Morris International Inc. PM. Each of our picks sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here .

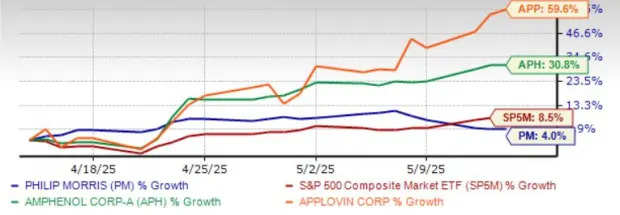

The chart below shows the price performance of our three picks in the past month.

Amphenol Corp.

Amphenol provides connectivity solutions using AI and ML (machine learning) technologies. It provides AI-powered high-density, high-speed connectors and cables, and interconnect systems optimized for signal integrity and thermal performance.

Amphenol benefits from a diversified business model. APH’s strong portfolio of solutions, including high-technology interconnect products, is a key catalyst. Expansion of spending on both current and next-generation defense technologies bodes well for APH’s top-line growth. Apart from Defense, APH’s prospects ride on strong demand for its solutions across Commercial Air, Industrial and Mobile devices.

The Andrew acquisition is expected to add roughly $0.09 to earnings in 2025. APH’s diversified business model lowers the volatility of individual end markets and geographies. Its strong cash-flow-generating ability is noteworthy.

Amphenol has an expected revenue and earnings growth rate of 30% and 38.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 12.9% in the last 30 days.

AppLovin Corp.

AppLovin is engaged in building a software-based platform for mobile app developers to enhance the marketing and monetization of their apps in the United States and internationally. APP provides a technology platform that enables developers to market, monetize, analyze and publish their apps.

AppLovin’s last reported financial results demonstrate its strong fundamentals and growth potential. The introduction of APP’s AI-powered AXON 2.0 technology and strategic expansion in gaming studios have significantly boosted revenue growth. APP’s Ai-enabled Audience+ marketing platform is also boosting its reach into direct-to-consumer and e-commerce space.

AppLovin has an expected revenue and earnings growth rate of 24.3% and 70.6%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 13.7% in the last seven days.

Philip Morris International Inc.

Philip Morris has benefited from strong pricing power and an expanding smoke-free product portfolio. PM has been making significant progress with its smoke-free transition, with products like IQOS and ZYN contributing to strong performance. In fact, PM aims to become substantially smoke-free by 2030.

Philip Morris is set for another year of robust growth in 2025, driven by increasing demand across all product categories. PM anticipates positive volume growth for the fifth consecutive year, with an expected increase of 2%. Smoke-free products remain a key growth driver, projected to expand by 12-14%, reinforcing PM’s strategic shift toward reduced-risk alternatives.

Philip Morris has an expected revenue and earnings growth rate of 8.1% and 13.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 4.2% over the last 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amphenol Corporation (APH) : Free Stock Analysis Report

Philip Morris International Inc. (PM) : Free Stock Analysis Report

AppLovin Corporation (APP) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research