News

Trump’s China climbdown lifts Britain’s growth forecasts

Britain’s economy is expected to grow faster than expected this year after the US and China struck a deal to temporarily reduce tariffs.

According to Goldman Sachs, the thaw in trade relations will add an extra 0.2pc to UK GDP over the course of 2025.

This means the Wall Street giant predicts Britain’s economy will grow by 0.6pc in the final nine months of the year, up from earlier forecasts of 0.4pc made before Donald Trump’s climbdown on China.

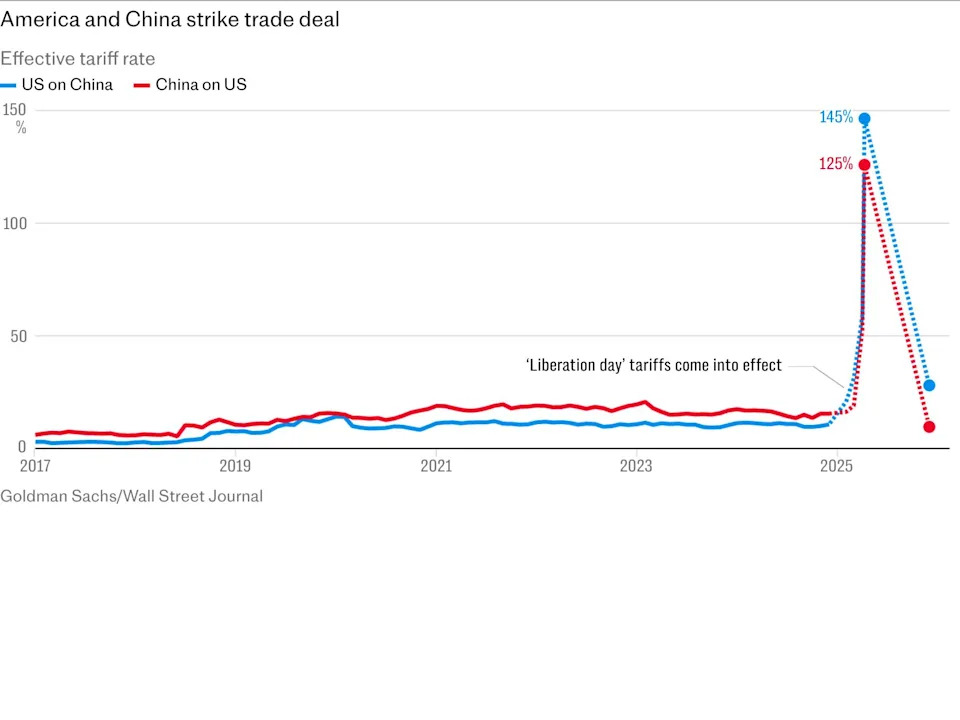

The upgrade signals a growing sense of optimism among economists and investors after the US agreed to lower its tariff rate on Chinese goods from 145pc to 30pc.

Beijing also reduced its duties on American products from 125pc to 10pc as part of the deal, which was announced by officials earlier this week.

It also comes after Britain became the first country to strike a trade deal with the Trump administration following his April 2 “liberation day” tariffs announcement.

This will offer the UK relief from the most aggressive US tariffs on car and steel exports .

Sven Jari Stehn, Goldman’s chief European economist, said its latest upgrade for the UK was down to “firmer growth abroad and easier financial conditions”.

However, the US bank said that the increase in growth would slow down the pace of interest rate cuts by the Bank of England.

It said policymakers would lower rates to 3pc by February next year, having previously forecast that they would come down to 2.75pc over the same period.

Nevertheless, it still expects borrowing costs to be lowered at consecutive meetings from August, after its economists predicted faster wage growth and a fall in services inflation.

Chancellor hires top investment banker

The upgraded projections offer some relief for Rachel Reeves , who has made securing economic growth one of her key missions.

The Chancellor on Wednesday hired one of the City of London’s top investment bankers in an effort to beef up the Treasury’s growth credentials.

Jim O’Neil, a senior investment banker at Bank of America, will take on the role of second permanent secretary to the Treasury, a position that has been open since 2022.

He was previously in charge of selling the Government’s stakes in Royal Bank of Scotland and Lloyds Banking Group during his time running UK Financial Investments (UKFI) after the global financial crisis.

The two lenders were bailed out with £66bn of taxpayers’ money in 2008.

Ms Reeves said Mr O’Neil’s knowledge would be “vital in helping us deliver our number one mission to grow the economy”.

Mr O’Neil said: “We are living through a time of great change globally, making the need for an economy of stability, resilience, and growth all the more important.

“I look forward to working with the Chancellor, her ministers, and officials across the department to deliver on these missions so the Treasury can bring positive change to the lives of people right across the country.”

Meanwhile, the latest US-China trade deal also led to Goldman Sachs cutting its recession forecast for America from 45pc to 35pc.

JP Morgan also lowered its probability of an American recession to less than 50pc, while Barclays scrapped its forecast for a “mild” US downturn.

Broaden your horizons with award-winning British journalism. Try The Telegraph free for 1 month with unlimited access to our award-winning website, exclusive app, money-saving offers and more.