News

Good News On Prices Wasn't Enough To Quell All of the Fed's Inflation Fears

Key Takeaways

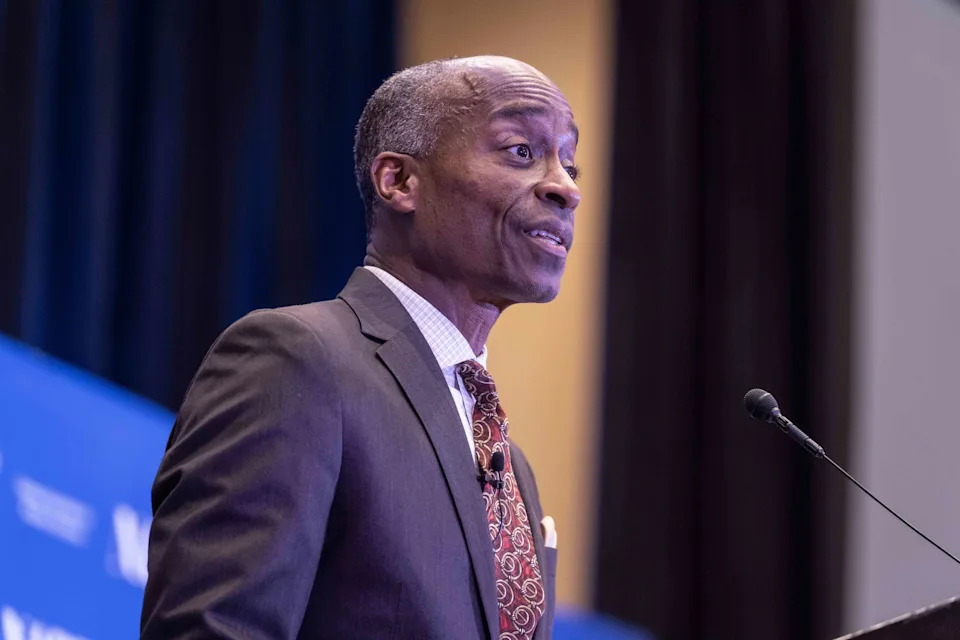

At least one official at the Federal Reserve is still skeptical about the trajectory of inflation and the economy, despite developments this week that cheered investors.

Philip Jefferson, vice chair of the central bank, said there was equal risk that

President Donald Trump's tariffs

could push up inflation and hurt the job market, speaking at a conference in New York Wednesday. With those two dangers in mind, he said, the Fed should wait and see what happens with the economy before making any changes to its monetary policy, such as cutting borrowing costs.

"If the increases in tariffs announced so far are sustained, they are likely to interrupt progress on disinflation and generate at least a temporary rise in inflation," Jefferson said. "Whether tariffs create persistent upward pressure on inflation will depend on how trade policy is implemented, the pass-through to consumer prices, the reaction of supply chains, and the performance of the economy."

Jefferson's remarks came on the heels of developments in the economy and Trump's trade war, which encouraged financial markets and

sent stocks soaring

. On Monday, U.S. and Chinese officials said the two nations would

drop some of the import taxes

they'd imposed on one another over the last few months. And on Tuesday, an official report on inflation showed

consumer prices rose less than expected

in April.

Still No Signs of Tariff-Related Economic Stress—Yet

In the early days of Trump's tariff campaign, surveys of individuals and businesses have flashed warning signs of job losses and higher prices ahead. However,

hard data

on unemployment and prices show few, if any, signs of distress.

The Federal Reserve's stance lately has been one of patience. The Fed is tasked with the "

dual mandate

" of keeping inflation and joblessness under control. The central bank's policy-setting committee uses its main tool, the influential

fed funds rate

, to try to keep both of those metrics stable.

Late last year, the Fed steadily cut rates from a 20-year high. The Fed has kept rates flat out of concern that Trump's tariffs could reignite inflation,

much to the president's ire

.

At the same time, business leaders and economists have warned tariffs could cause an economic slowdown and job losses, which the Fed could address by cutting its benchmark interest rate. A lower fed funds rate could make all kinds of loans cheaper, boosting the economy and hiring, though at the risk of stoking inflation.

The latest inflation data haven't been enough to completely quell those fears of price increases, at least not for Jefferson, one of 12 officials who vote on interest rate moves.

"With the increased risks to both sides of our mandate, I believe that the current stance of monetary policy is well positioned to respond in a timely way to potential economic developments," Jefferson said.

Read the original article on Investopedia