News

Datadog’s (NASDAQ:DDOG) Q1 Sales Top Estimates, Next Quarter’s Sales Guidance is Optimistic

Cloud monitoring software company Datadog (NASDAQ:DDOG) reported Q1 CY2025 results exceeding the market’s revenue expectations , with sales up 24.6% year on year to $761.6 million. Guidance for next quarter’s revenue was optimistic at $789 million at the midpoint, 2.5% above analysts’ estimates. Its non-GAAP profit of $0.57 per share was 34.4% above analysts’ consensus estimates.

Is now the time to buy Datadog? Find out in our full research report .

Datadog (DDOG) Q1 CY2025 Highlights:

"Datadog executed solidly in the first quarter, with 25% year-over-year revenue growth, $272 million in operating cash flow, and $244 million in free cash flow," said Olivier Pomel, co-founder and CEO of Datadog.

Company Overview

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ:DDOG) is a software-as-a-service platform that makes it easier to monitor cloud infrastructure and applications.

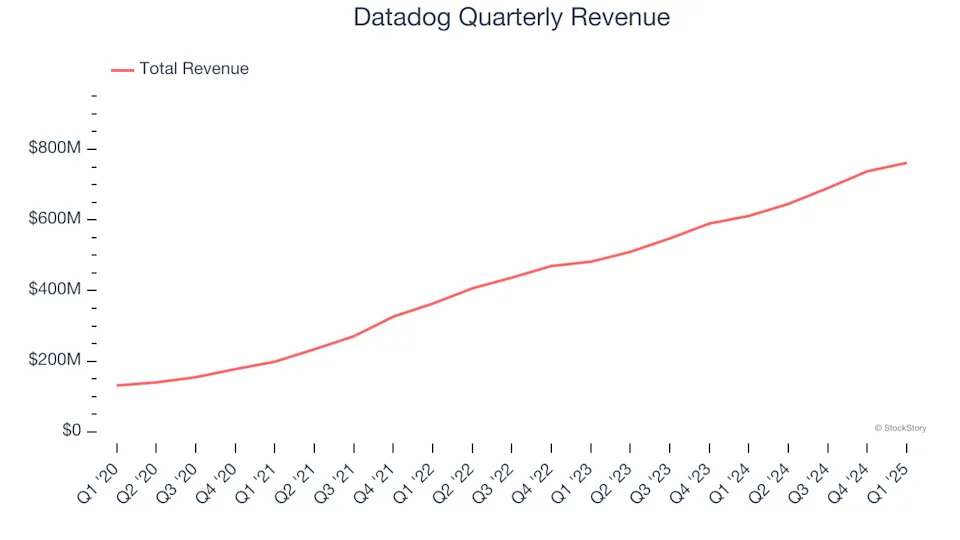

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Thankfully, Datadog’s 33.4% annualized revenue growth over the last three years was excellent. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Datadog reported robust year-on-year revenue growth of 24.6%, and its $761.6 million of revenue topped Wall Street estimates by 2.8%. Company management is currently guiding for a 22.3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 17.5% over the next 12 months, a deceleration versus the last three years. Still, this projection is admirable and implies the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. .

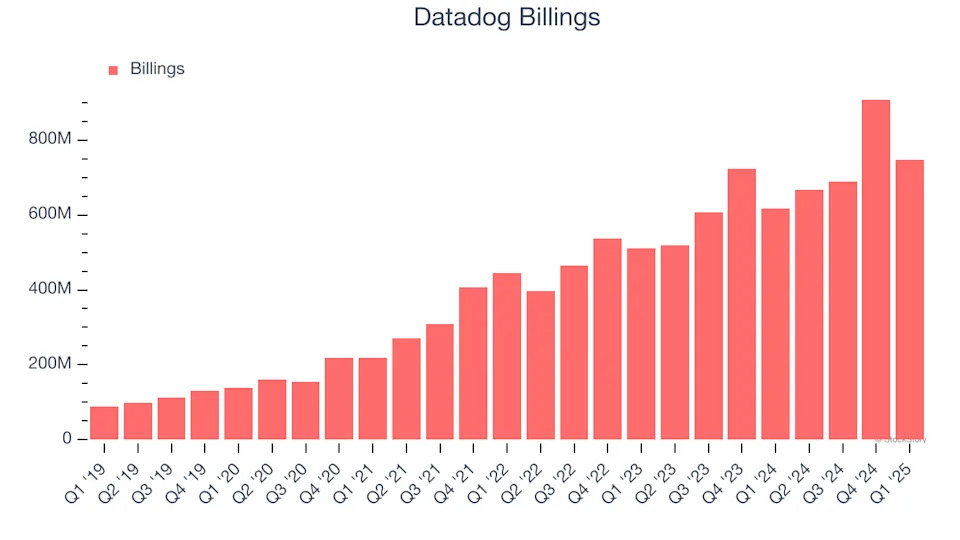

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Datadog’s billings punched in at $747.7 million in Q1, and over the last four quarters, its growth was impressive as it averaged 22.2% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

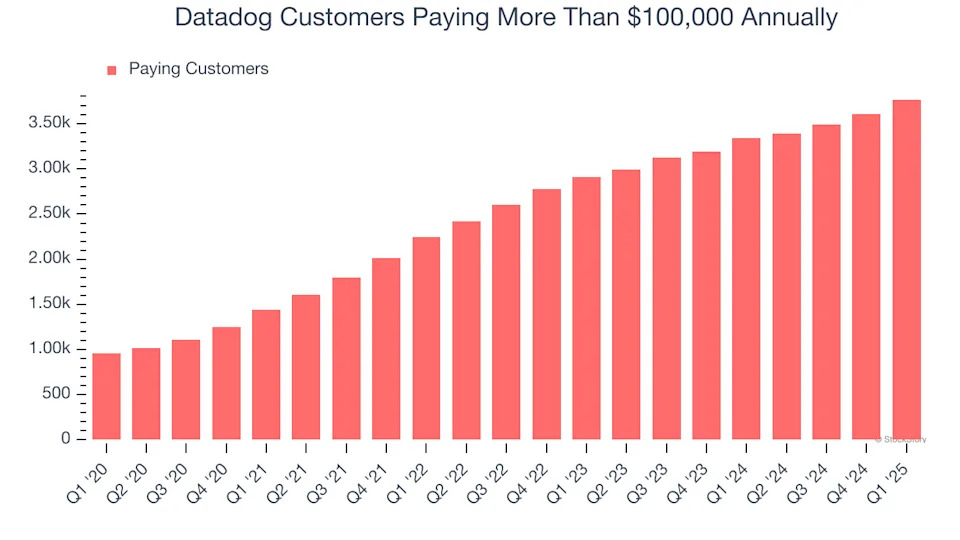

Enterprise Customer Base

This quarter, Datadog reported 3,770 enterprise customers paying more than $100,000 annually, an increase of 160 from the previous quarter. That’s quite a bit more contract wins than last quarter and quite a bit above what we’ve observed over the previous year. Shareholders should take this as an indication that Datadog’s go-to-market strategy is working well.

Key Takeaways from Datadog’s Q1 Results

This was a 'beat and raise' quarter. We enjoyed seeing Datadog accelerate its new large contract wins this quarter, leading to a revenue beat. We were also glad its revenue guidance for next quarter exceeded Wall Street’s estimates. For the full year, the company raised its revenue and EPS guidance, although the latter was just in line with Wall Street’s estimates. Overall, this print wasn't perfect but had some key positives. The stock traded up 4.4% to $110.40 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free .