News

Energizer (NYSE:ENR) Reports Sales Below Analyst Estimates In Q1 Earnings, Stock Drops

Battery and lighting company Energizer (NYSE:ENR) fell short of the market’s revenue expectations in Q1 CY2025, with sales flat year on year at $662.9 million. Next quarter’s revenue guidance of $694.4 million underwhelmed, coming in 2.7% below analysts’ estimates. Its non-GAAP profit of $0.67 per share was in line with analysts’ consensus estimates.

Is now the time to buy Energizer? Find out in our full research report .

Energizer (ENR) Q1 CY2025 Highlights:

"We are proud of our performance in the quarter, as our investments have enabled continued momentum in our top-line and the operating flexibility to effectively offset the impact from tariffs to our fiscal 2025 results." said Mark LaVigne, Chief Executive Officer.

Company Overview

Masterminds behind the viral Energizer Bunny mascot, Energizer (NYSE:ENR) is one of the world's largest manufacturers of batteries.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $2.90 billion in revenue over the past 12 months, Energizer carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

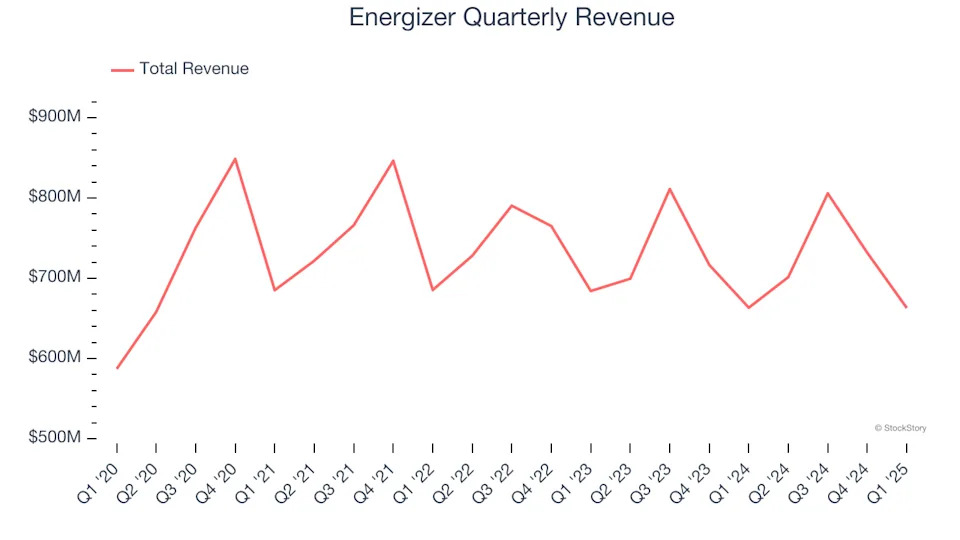

As you can see below, Energizer’s demand was weak over the last three years. Its sales fell by 1.3% annually, a tough starting point for our analysis.

This quarter, Energizer missed Wall Street’s estimates and reported a rather uninspiring 0.1% year-on-year revenue decline, generating $662.9 million of revenue. Company management is currently guiding for a 1% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months. While this projection suggests its newer products will catalyze better top-line performance, it is still below average for the sector.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link .

Organic Revenue Growth

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

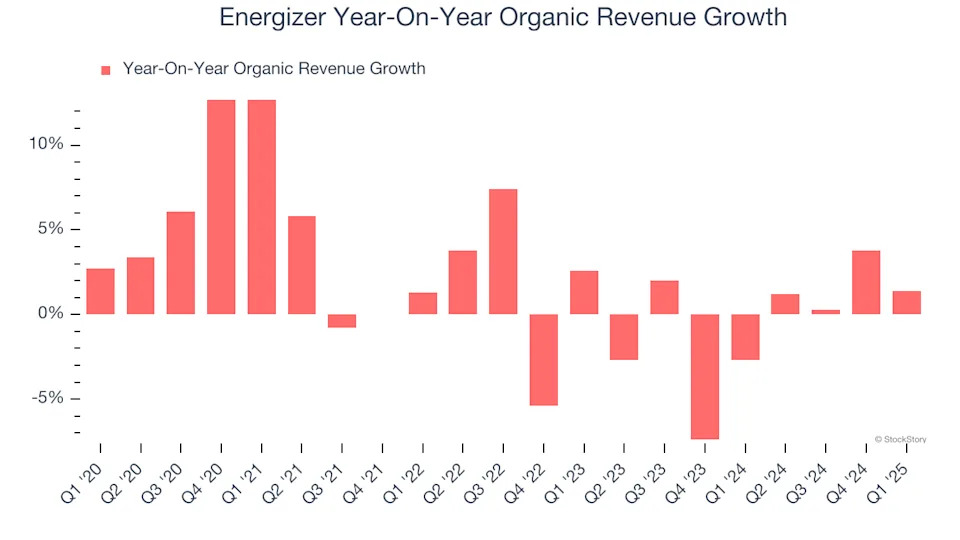

The demand for Energizer’s products has barely risen over the last eight quarters. On average, the company’s organic sales have been flat.

In the latest quarter, Energizer’s organic sales rose by 1.4% year on year. This growth was a well-appreciated turnaround from its historical levels, showing the business is regaining momentum.

Key Takeaways from Energizer’s Q1 Results

It was encouraging to see Energizer beat analysts’ EBITDA expectations this quarter. On the other hand, its EPS guidance for next quarter missed significantly and its gross margin fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 5.3% to $24.50 immediately following the results.

Energizer didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free .